Roanoke Valley Market Snapshot Q3 2020

By: Patrick Wilkinson

Posted 10/12/2020

Welcome to LivingInRoanoke.com’s Market Snapshot! You are very special to me, so please enjoy…

Here you’ll find in-depth analysis, graphs and data, of residential real estate sales for the Roanoke Valley of Virginia based on data from RVAR*. Be sure to see trends in (record low) mortgage interest rates at the end. You are welcomed to share this with your friends, and share on Facebook or Twitter (just click share buttons at the top or bottom of the page). Thanks! Patrick

“The Great Shut Down” is mostly in the rearview mirror! Q3 2020 ended with Roanoke Valley homes sales over Q3 2019 sales. While “The Virus Crisis” is continuing to have its effect on the US Economy, the Roanoke Valley housing market is on track to be a record ALL TIME HIGH in 2020. As I said 6 months ago, “The numbers for 2020 will show the true effect of what has transpired, and it may not be pretty.” BUT I WAS WRONG!!!

The GREAT NEWS: The economic fundamentals were excellent prior to this forced shut down, and we are now snapping back to excellent economic fundamentals. In fact, as you will see below, the total for the first three quarters of 2020 sales is EXCEEDING 2019 in all areas. My “pent up demand” theory from my post in April 2020, which I predicted 6 months ago was correct, but has exceeded my expectations. A recent NAR Article highlights the current condition of the national “Pending Home Sales Index” which has just hit another record high. Here’s my updated theory on why things are going so well in the Roanoke Valley Market Snapshot Q3 2020

THEROY – WHY REAL ESTATE SALES ARE ON FIRE

- National unemployment rate reached a 20% maximum in Q2 (80% employed)

- Now the national unemployment rate is down to 7.9% (NCSL report)

- Unemployed were, for the most part, in entry level or lower income positions

- Those still employed still have income, liquid funds, and good credit for a loan

- The interest rates plummeted due to economic fear (see bottom of this report)

- Some sellers began removing homes from MLS in March in fear of catching illness

- Limited homes available set up a frenzy for buyers who could still buy

- Inventory of homes is still extremely low in the Roanoke Valley (only 893 Active)

It is possible, once The Roanoke Valley has fully rebounded, that we’ll see a housing boom like there hasn’t been in 60 years. And it is possible this comeback will more than make up for the weakness caused by the shut down in Q2 & Q3 2020.

Q3 2020 THOUGHTS

Sales of Q3 2020 residential property in the Roanoke Valley were strong, 1,914 homes sold (RVAR to date for Q3). Additionally, the TOTAL number of homes sold in the entire first three quarters of 2020 was 4,777 homes, as compared to first three quarters of 2019 at 4,479 homes (a for 2020 so far). Additionally, the average sale price in 2020 is higher, and the days on the market are lower than 2019 (see charts below). So 2020 is still setting up to be the best year in Roanoke Valley history. Here are the two BIG indicators of future hot market growth:

First, “Active In Range” (or AIR) means number homes that were on the market during that time period. The Q2 AIR has significantly decreased each year since 2011 (bottom of the market), and is at its lowest point right now ever. This is good news for home sellers because fewer active homes on the market means there is less competition for qualified buyers.

– In Q3 of 2020 there were 3,325 homes AIR (lower is better for sellers!)

– In Q3 of 2019 there were 4,027 homes AIR

– In Q3 of 2011 there were 6,396 homes AIR (dark days of the real estate crash)

And second, “Absorption Rate” which is the rate, expressed in months, at which the entire supply of homes will sell out if no more homes were added to the market. According to an article by NAR “six months‘ supply is considered a balanced market.” The Q3 2020 Absorption Rate for the Roanoke Valley was 1.4 months (until all inventory would be sold out). This actually puts us in the “danger zone” for running out of inventory since the NAR says a 6 month supply is “normal”.

This means 2020 is currently a phenomenal year for home-sellers. And sellers only do well if buyers have access to great loans. Interest rates have come down significantly in the last 6 months to historic lows, making excellent loan programs available to home buyers. Take a look at rates at the end of this post.

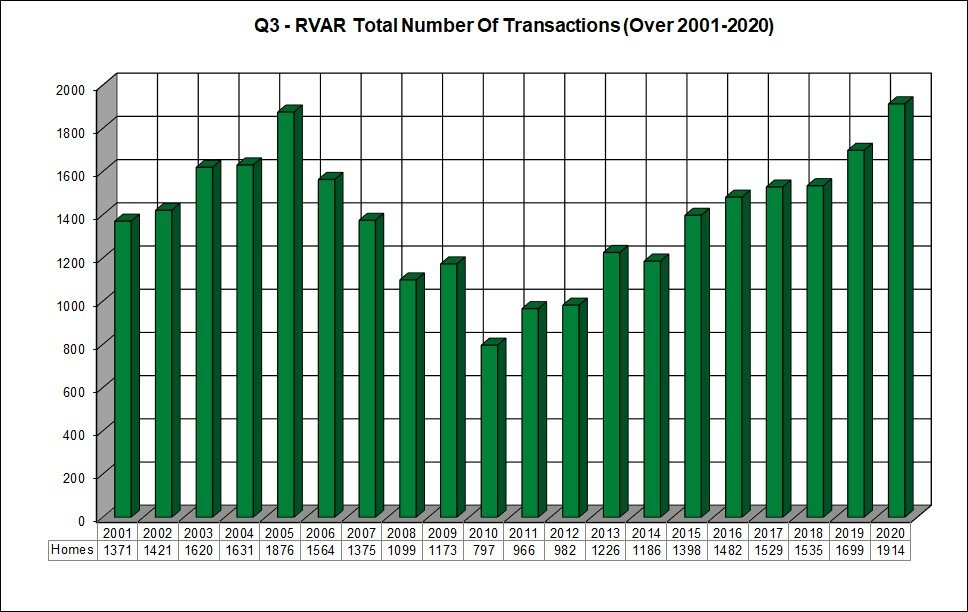

3rd Quarter – 2020 – HOME SALES ()

– Chart below illustrates Q3 home sales for each year from 2001 to 2020

– Average Q3 home sales during those 20 years equals 1,392 homes

– Q3 2020 sales (1,914) are higher by 522 homes () over 20-yr Q3 average (1,392)

– Q3 2020 sales (1,914) are higher by 215 homes () from Q3 2019 (1,699)

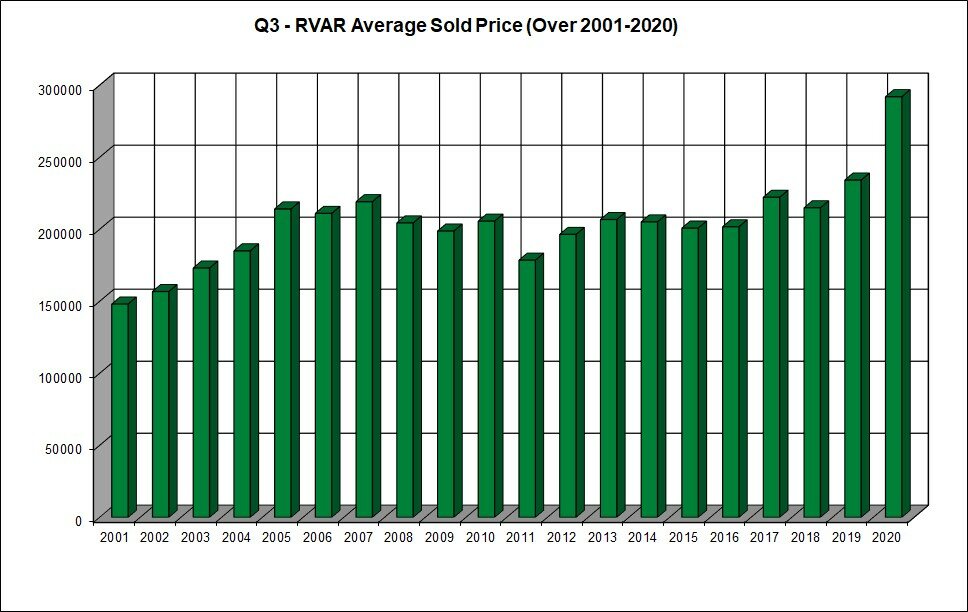

3rd Quarter – 2020 – AVERAGE PRICE ()

– Chart below illustrates Q3 average sales price for each year from 2001 to 2020.

– Average Q3 home sales price during those 20 years equals $203,440

– Q3 2020 price ($292,022) higher by $88,582 () over 20-yr Q3 ($203,440)

– Q3 2020 price ($292,022) higher by $57,865 () from Q3 2019 ($234,157)

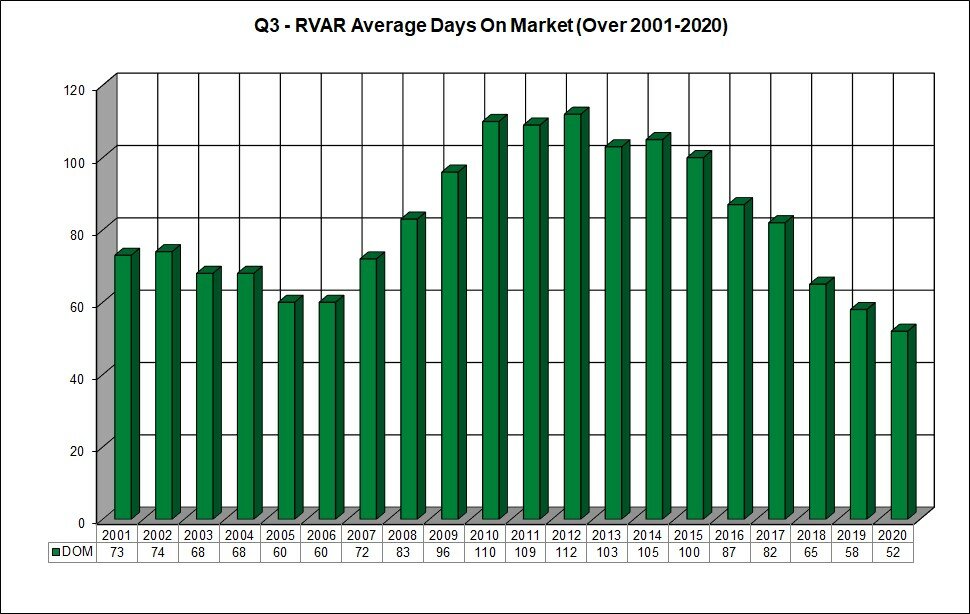

3rd Quarter – 2020 – AVERAGE DAYS ON MARKET (DOM) ()

– Chart below illustrates Q3 average DOM for each year from 2001 to 2020.

– Average Q3 DOM during those 82 years equals days

– Q3 2020 DOM (52) is lower by 30 days (36.58% down) over 20-yr Q3 average (82)

– Q3 2020 DOM (52) is lower by 6 days (10.34% down) from Q3 2019 (58)

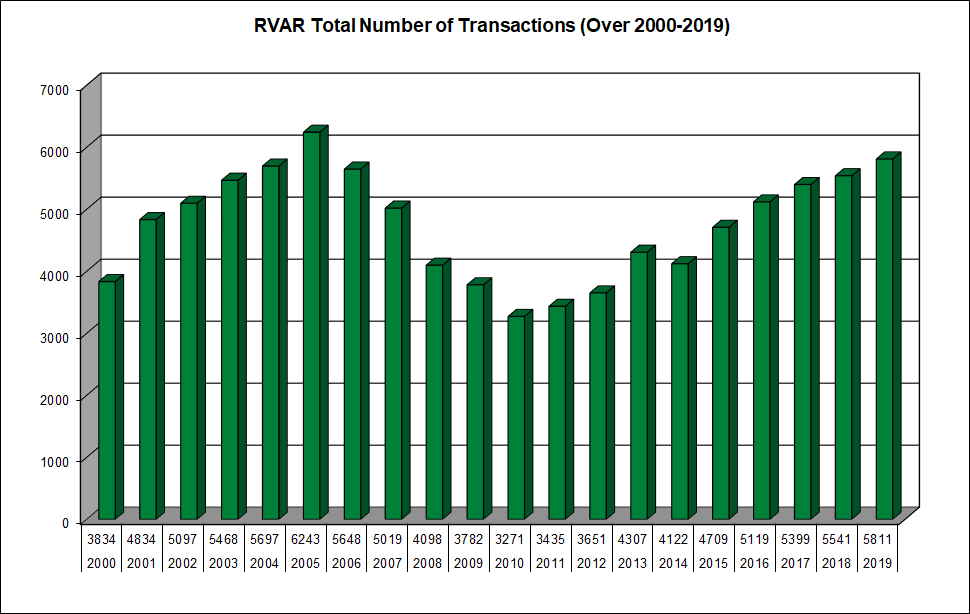

Total RVAR Annual Sales 2000 through end of 2019 (will update at end of 2020)

– Chart below illustrates annual home sales for each year from 2000 to 2019.

– Average annual home sales during those 20 years equals 4,754 homes

– 2019 sales (5,811) higher by 1,057 homes () over 20 year avg (4,754)

– 2019 sales (5,811) higher by 270 homes () over 2018 sales (5,541)

TODAY’S MORTGAGE RATES** & HISTORY – As of 10/12/2020

According to Bankrate.com the following mortgage interest rates** are available today on a $375,000 purchase price (monthly payment combines only principal and interest)

30-Yr Fixed:

3.429% APR (3.375% rate, $300k loan, 20% down, 740+ credit, 0 pts, $1,326/mo payment)

15-Yr Fixed:

2.273% APR (2.250% rate, $300k loan, 20% down, 740+ credit, 0 pts, $1,965/mo payment)

5/1 Adj Rate:

2.772% APR (2.750% rate, $300k loan, 20% down, 740+ credit, 0.125 pts, $1,225/mo payment)

To see a chart of last 30 year history of mortgage rates: Click Here

Historical charts courtesy of Jamey Roberts at RMH Mortgage.

*The RVAR is the Roanoke Valley Association of Realtors and owns the Roanoke MLS, from which all RVAR housing data was obtained.

** All loans are subject to credit approval. These rates are not an offer of financing. Every home buyer must be approved through a qualified lender. Loan programs and rates subject to change. The Real Estate Group and/or LivingInRoanoke.com, and/or Patrick Wilkinson, is not / are not a lender.

The Roanoke Valley Market Snapshot Q3 2020

– Patrick Wilkinson, Living In Roanoke